How Others Spend Their Income

Many people have questions about how other families spend their income.

How much of my money should be spent on food, clothing, etc.?

Am I spending more than everyone else?

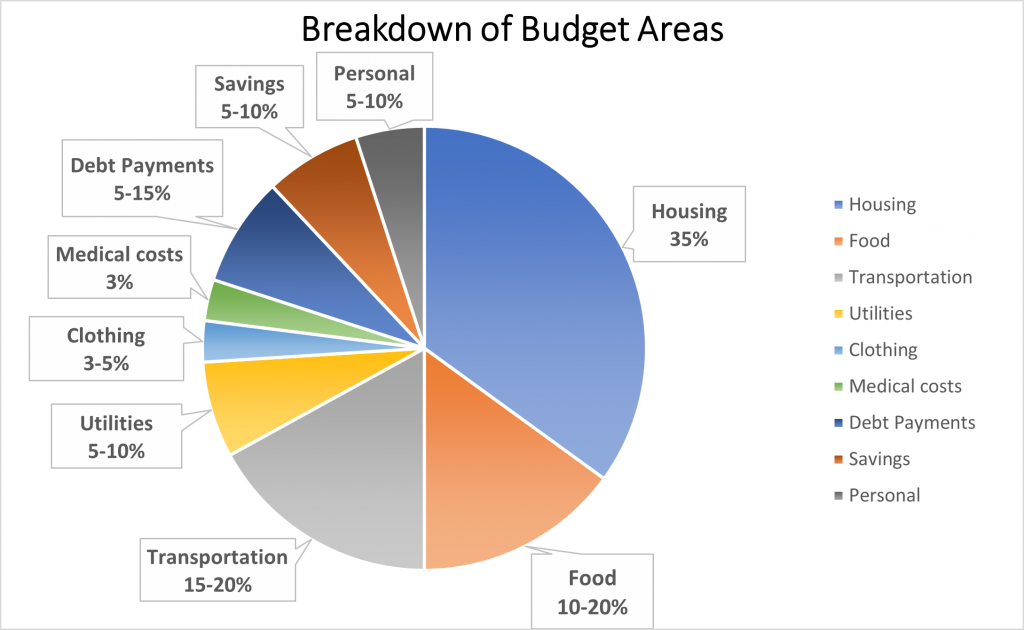

The Credit Counselling Society provides the following Canadian guidelines to give an idea of what percentage of income Canadians should be spending on the main budget categories:

What’s included:

| Housing 35% | mortgage payment, rent, taxes, home insurance, hydro |

| Food 10-20% | groceries, personal care items (toilet paper, shampoo, etc.) |

| Transportation 15-20% | bus fare, taxi, gas, car insurance and maintenance, parking |

| Utilities 5-10% | land line, cell phone, internet, TV services |

| Clothing 3-5% | clothing and shoes for all family members |

| Medical costs 3% | over the counter medications, dental, glasses, any paid-for services and health insurance premiums |

| Debt payments 5-15% | loans, credit card, lines of credit |

| Savings 5-10% | emergency funds, retirement, future goals |

| Personal 5-10% | entertainment, beauty, recreation, eating out, alcohol & tobacco, hobbies |

These percentages are only guidelines and they will be different based on your family circumstances, your income and where you live in Canada.

As an example, if you live in the northern part of Canada, your food costs will be higher and the other categories will have to be adjusted to make up for this.

BUDGETING RESOURCES:

For a free, interactive budgeting spreadsheet that will break your budget into these categories, download the Budget Calculator Spreadsheet from MyMoneyCoach.ca

Another excellent free Budget Planner and Expense Tracker is available for download from Credit Canada.

Read these articles next:

Budgeting Basics

Creating a Budget